Product Highlights

Modern ALCO Does Not Doubt the Numbers

By Patricia Llorente

December 11, 2025

ALCO sits at the center of balance sheet steering. It is where the bank aligns liquidity, funding, risk and profitability and decides how to respond to a world that rarely stands still. But a strong committee alone is not enough; it requires an operational system behind it, capable of handling changing and growing demands.

Market conditions often move faster than reporting cycles. Rates shift, liquidity pressures emerge, regulations tighten and macro or political events can quickly reshape the outlook. Yet the information flowing into ALCO depends on heavy preparation, manual consolidation and reconciliation of data from disconnected views across different business units.

Market conditions often move faster than reporting cycles. Rates shift, liquidity pressures emerge, regulations tighten and macro or political events can quickly reshape the outlook. Yet the information flowing into ALCO depends on heavy preparation, manual consolidation and reconciliation of data from disconnected views across different business units.

Most banks do extraordinary work to make this possible on time. But the reality is that transforming thousands of data points into one coherent ALCO pack takes time, and that limits how quickly executives have access to the full picture. When new angles or scenario variations surface during meetings, the follow up often requires several days of reconstruction. And even with the best teams, it is difficult to see how a funding decision might influence NII or how a liquidity shift might affect IRRBB or regulatory ratios, without going back to fragmented non-holistic reports.

A modern ALCO needs something radically different. It needs clarity on the drivers behind the numbers. It needs a way to understand how each decision influences liquidity, interest rate risk, profitability and regulations, not in isolation but as a connected whole. And it needs to keep momentum, even when the market creates new questions between meetings.

This is the gap Mirai was built to close.

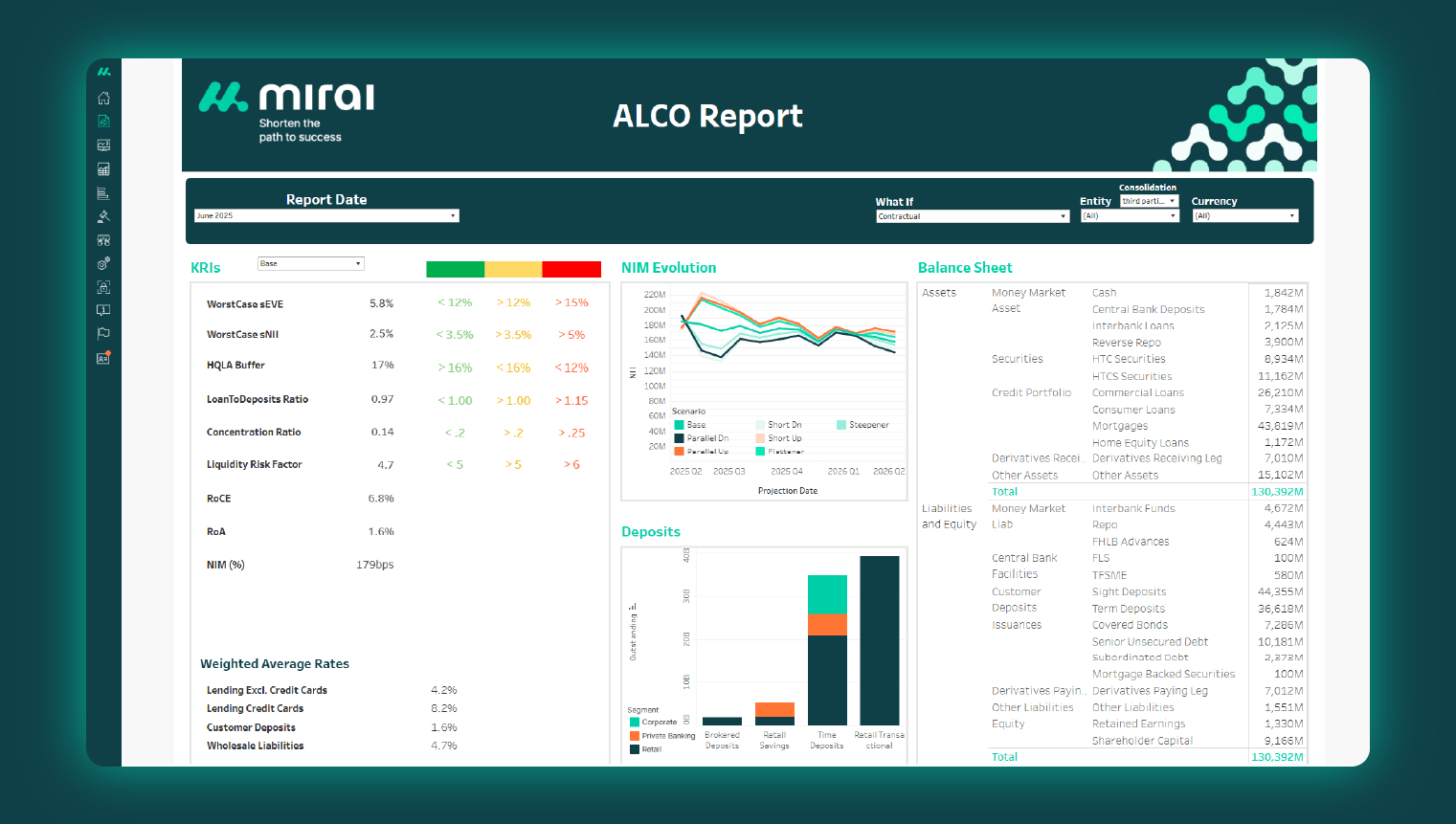

Mirai brings the entire balance sheet management workflow together in one integrated platform. From data ingestion to modeling, forecasting and reporting, everything flows through a shared data model that stays consistent, transparent and traceable from the moment it’s loaded. The same data feeds every chart, every scenario and every dashboard, so the ALCO gets single, trusted and traceable view across Treasury, ALM, Risk, FTP and Finance.

The reporting layer sits directly on top of the transaction-level dataset, which means insights are automatically aligned with the models and assumptions behind them. Executives can quickly see how various internal and external changes interact simultaneously across the bank through connected views, all within a flexible reporting dashboard. For example, they can see how a merger would impact funding or how a competitor’s move influences portfolio strategy. Mirai enables the execution of multiple simultaneous scenarios without impacting execution times, providing integrated cross-metric analysis that clarifies cross-impacts and moves discussions away from concerns about data reliability toward a focus on evaluating trade-offs desired business outcomes.

When circumstances change, scenarios can be adapted and refreshed and reports updated in hours instead of days. This allows the committee to stay informed, act upon with coherence and keep alignment across functions. Instead of manual reconstruction, teams work with a unified foundation that simplifies the preparation cycle and strengthens governance.

The result is an ALCO that operates with greater confidence and clarity. Decisions move faster, the conversation becomes timelier strategic, and the committee can focus on what truly matters: understanding the implications of each choice for the bank’s balance sheet and taking action with conviction.

Banks do not need more reports; they need a process that keeps pace with the speed and complexity of the market. Mirai delivers exactly that to ALCO.

Curious to see it in action? Watch the video!

Other articles

Product Releases