Mirai ALM & Liquidity Solution

Manage IRRBB & Liquidity

Risk to optimize your

risk-return profile

Gain an accurate view of the profitability, earnings

stability and overall risk exposure of your balance

sheet and ensure adequate liquidity.

Gain a firm grasp of interest rate and liquidity risks

Why choose the Mirai ALM &

Liquidity Solution?

Managing the risks arising from mismatches between assets and liabilities is crucial for the health and profitability of financial institutions. This task is becoming increasingly challenging due to uncertainties about future market developments, stricter regulations, fluctuating market rates, and evolving customer behavior. Meeting these challenges requires banks to rely on a powerful, flexible and transparent ALM solution that enables a rapid transition from data to insight and from insight to action.

At Mirai, we have developed the fastest and most intuitive cash flow forecasting and simulation engine on the market, powering our ALM & Liquidity solution. With a user-friendly interface, advanced scenario creation, market-leading modeling granularity, and real-time data integration, banks can swiftly assess and respond to risks, enhancing proactive balance sheet management.

Mirai ALM & Liquidity

Solution Highlights

Unified IRRBB,CSRBB, liquidity risk & financial planning

Monitor, manage and report all aspects of IRRBB and liquidity risk, in one single solution for comprehensive oversight.

Lightning-fast & comprehensive modeling & simulation

Harness our flexible stress testing framework, featuring what-if analysis, to promptly develop a wide range of scenarios to assess potential risks and impacts.

Superior data granularity for advanced reporting

Leverage a solution integrates analytical capabilities featuring contract-level data granularity, facilitating the creation of highly customized reports with ease.

Deep dive into our advanced functionality

Mirai ALM & Liquidity Solution Capabilities

Powered by our cloud-native platform, our ALM & Liquidity solution introduces transformative use cases.

Effective measurement and modeling of IRRBB, CSRBB and liquidity risk

Access a robust implementation of interest rate and liquidity risk management tailored to organizational needs and covering all regulatory requirements. Leverage predefined reports with key ALM metrics, ensuring proper governance and decision-making.

- Net Interest Income (NII) and Economic Value of Equity (EVE) sensitivities

- Gap risk (Interest & Liquidity): Liquidity and repricing cash flow gap analysis on user-defined time buckets

- Yields, durations, and convexities

- Cash flow optimization

- Key liquidity management metrics adaptable to the bank's requirements (survival horizon, liquidity buffer, concentration, and more)

- Rigorous documentation of all processes

Support of multiple charts of accounts and balance sheet structures

Create multiple charts of accounts plans or balance sheet structures by drawing from both consolidated and unique data sources. Simulate a wide array of behavioral models, balance sheet structures, and scenarios, each with its own set of parameters, all without needing to create multiple data models or instances. To facilitate parameterization and reduce operational load, Mirai offers group accounts, enabling the modeling of balances at different levels of aggregation when assigning financial behaviors, new business assumptions, and other factors.

Ongoing management, financial planning and forecasting

Real-time management capability, providing updated insights for daily control of key metrics in your ALM operations. Forecast the balance sheet at any chosen level, down to the lowest granularity, with automated dashboard creation for different management boards to facilitate information sharing among multiple lines of business and key stakeholders.

- Detailed projection of net interest margin

- Unlimited simulation capacity for potential alternative management measures

- Automatic generation of internal transfer rates (FTPs)

- Generation of key metrics for budgeting

- Segmentation of information by sectors/geographies/currencies, etc.

- Financial profitability analysis of products/customers/segments, etc.

- Guidelines for improving balance sheet management optimization

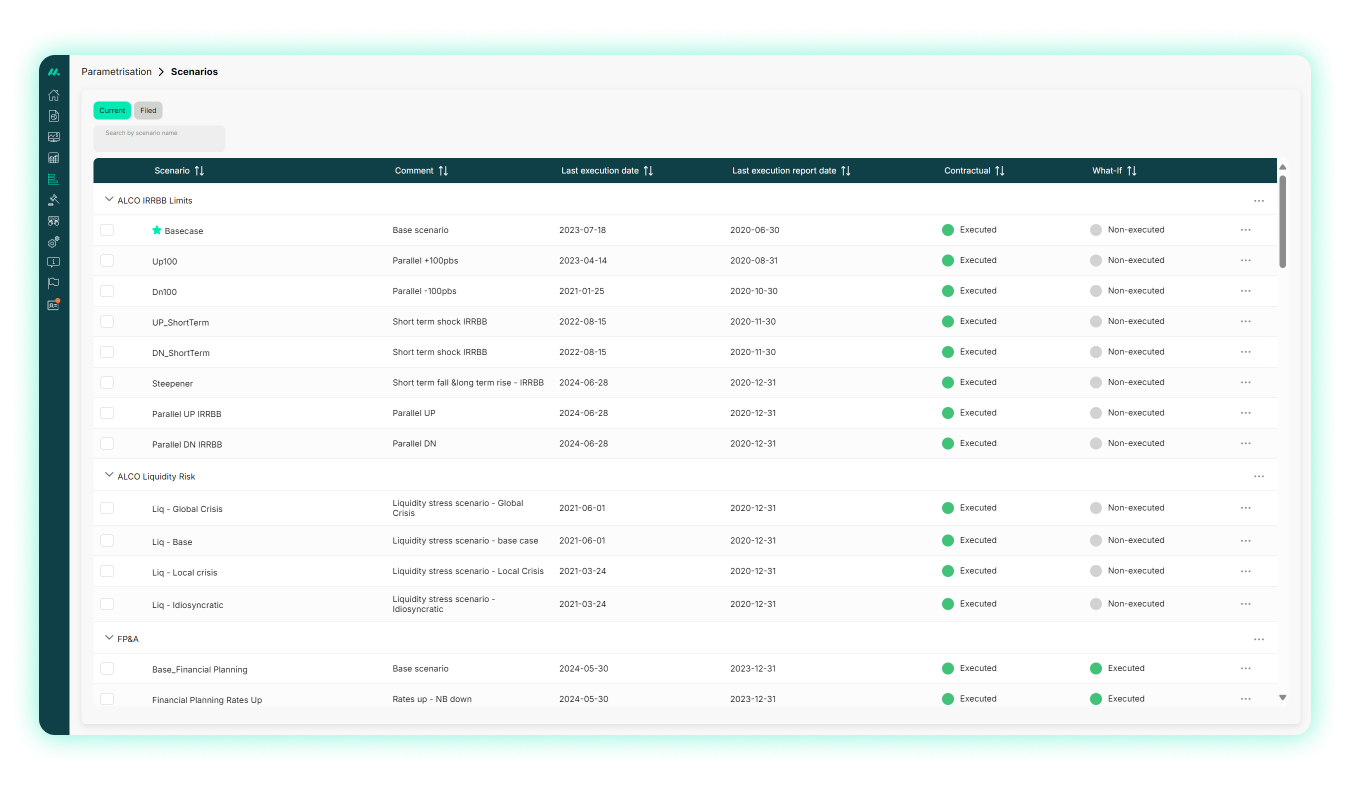

Flexible stress testing, what-if analysis and scenario creation

Access predefined assumptions to extrapolate the entire balance sheet over a future time horizon, delivering a rich set of results on projected dates, including income, sensitivities, gap profiles, cash flows, and liquidity ratios. Analyze outcomes without time constraints by modeling, executing and storing an unlimited number of custom user-defined scenarios, leveraging sensitivity analysis to evaluate their resilience. Access various methods to stress-test base models within each scenario, facilitating dynamic adjustment of key parameters associated with the baseline case.

- Market factors

- Entities

- Data variance

- Temporal structure

- Chart of accounts

Advanced modeling with full auditability

Create customer behavior models ranging from simple to highly complex. Introduce formulas that model customer behavior, differentiate between current stock and new business, and create scenario-based models that dynamically depend on the evolution of interest rates or other external factors. All this is done with complete transparency and full auditability, with to consult at the contract level, metric, scenario and date of all historical results ensuring clear data lineage throughout the process.

Granular analytics that enable report customization

Craft advanced reports effortlessly and intuitively, facilitating information sharing among multiple lines of business and key stakeholders. Generate reports tailored for committees at different levels, providing detailed insights for departmental daily meetings and concise snapshots for high-level committees. These reports cater to front-line and second-line committees, including ALCOs, the Risk and Supervision Executive Committee, the Management Committee, public reports, and more.

Ready to unlock your

balance sheet’s full potential?

Reach out to our expert team to schedule a personalized

demo and see a live solution walkthrough.