Mirai FTP & Profitability Solution

Manage NII volatility

to drive sustained profitability

Break down the transfer price at the contract level

into its components with the highest level of

granularity and full auditability.

Understanding Net Interest Income (NII)

Why choose the Mirai FTP &

Profitability Solution?

Net Interest Income (NII) is a critical metric for financial institutions, impacting shareholder capital infusion. The Mirai FTP & Profitability solution allows banks to build a transparent system for measuring profitability by breaking NII into its underlying components. It clarifies past profitability drivers, aids in pricing strategies for future earnings, and reduces uncertainty in financial planning.

Banks can use this insight to manage NII volatility, efficiently managing NII across diverse business areas and changing rate scenarios. This process shields business units from risks related to interest rates and liquidity, while centrally managing them through an ALCO-managed mismatch center. By accurately integrating costs like liquidity and funding, our FTP solution adapts to the unique needs of every bank, enabling precise internal funding rates and fostering sustained profitability.

Mirai FTP & Profitability

Solution Highlights

Comprehensive Calculation Methodologies

Leverage industry-leading transfer pricing methods featuring accurate base rate calculations for every instrument on the balance sheet.

FTP Extension into the Balance Sheet Forecast

Incorporate forward-looking transfer pricing into asset liability management scenarios, along with planning and budgeting.

Detailed Profitability Analysis

Compute profitability across multiple levels, from individual contracts to broader categories such as cost centers and business lines.

Deep dive into our advanced functionality

Mirai FTP & Profitability Solution Capabilities

Powered by our cloud-native platform, our FTP & Profitability solution introduces transformative use cases.

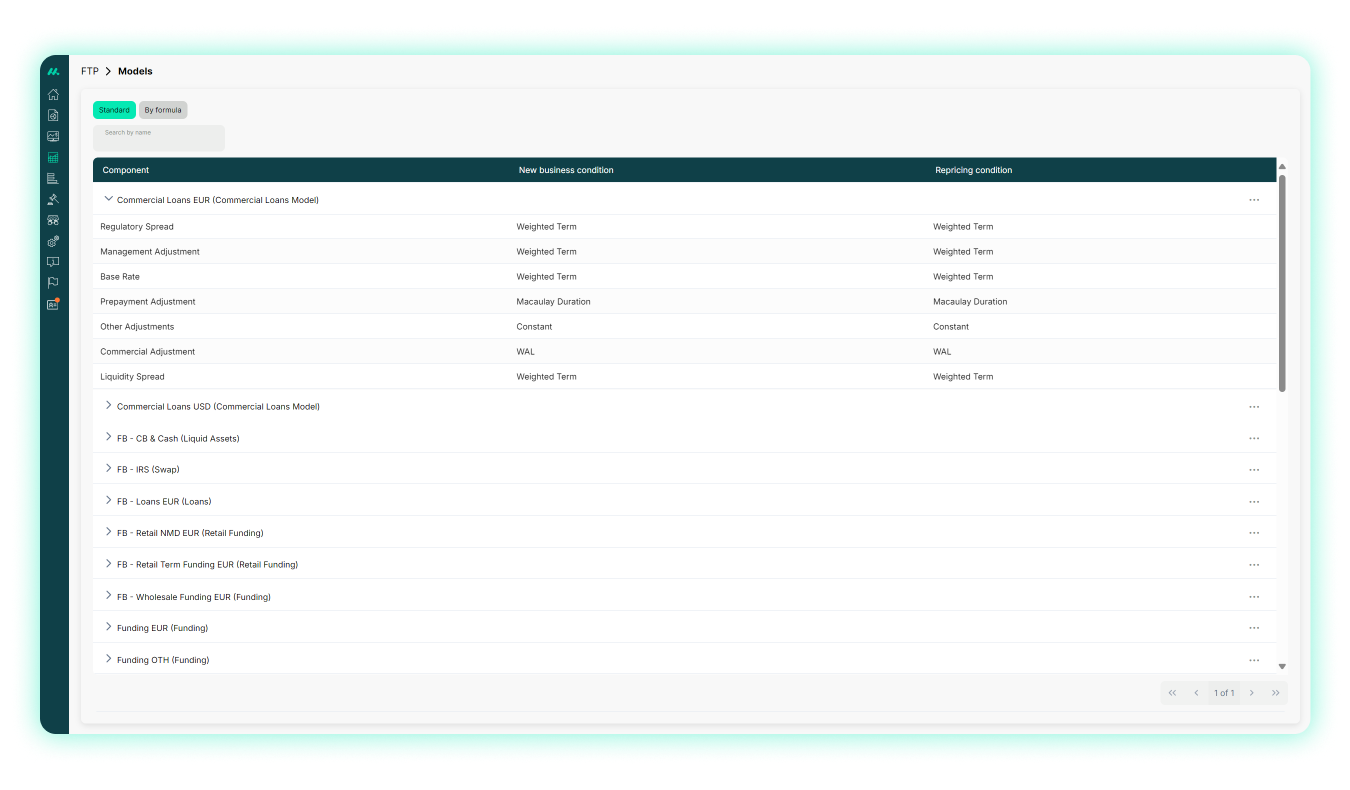

Extensive Transfer Pricing Calculation Methods

Access a comprehensive array of calculation methodologies for each FTP component, enabling modeling at varying levels of granularity based on required cost allocation. This ensures pricing alignment with the financial behavior of the product and the specific characteristics of the FTP component. Non-cash flow transfer pricing methods:

- Constant

- Hybrid

- Moving average

- Repricing term

- Solve method

Cash flow transfer pricing methods:

- Macaulay duration

- WAL (Weighted Average Life)

- Weighed term

- Yield to maturity

- Zero discount factor

Non-standard transfer pricing methods:

- Average yield method

- Guaranteed minimum margin

- Annual guaranteed margin

Transfer Rate & Spread Assignment

Conduct transfer rate assignments, considering contract-specific rules from actual datasets, planned contracts in the pipeline, and non-maturing contracts. This ensures precise and dynamic rate assignments that reflect the real-time status of your portfolio, enabling resource allocation and optimization of pricing strategies. Assign spreads to allow for flexible combinations of standard and user-defined spreads, facilitating a deeper understanding of profitability factors through a detailed breakdown of margin components over time.

Breakage Charge Calculations

Capture breakage charges associated with the early termination of fixed-rate contracts. The associated breakage costs for break funding events, such as prepayment events, are calculated internally as part of the FTP process, and the business is charged for the related economic loss.

Detailed Margin & Profitability Analysis

Conduct profitability calculations based on accruals and store them at the level of each individual contract. Establish margin allocations between funding and responsibility centers. The income calculation seamlessly integrates over time and can be analyzed across business units, products, and customers. Analyze revenue and cost data to determine the net profit for each level, identify key drivers of profitability, and assess the financial performance of specific currencies, client segments, and operational units. Gain insights into which contracts, cost centers, and business lines contribute the most to overall profit.

Ready to achieve efficient

profitability?

Reach out to our expert team to schedule a personalized

demo and see a live solution walkthrough.