Mirai Regulatory Reporting Solution

Unlock continuous

regulatory compliance

Seamlessly automate reporting from data input

through regulatory submission for streamlined

compliance, contractually guaranteed.

Stay ahead of all regulatory obligations

Why choose the Mirai

Regulatory Reporting Solution?

Financial institutions are facing heightened scrutiny from regulators, coupled with expanding and more rigorous regulations. With regulatory policies evolving worldwide, banks are experiencing a surge in the volume, frequency, and complexity of reporting requirements.

Mirai offers a specialized regulatory solution for navigating IRRBB, CSRBB and liquidity risk reporting requirements, covering global and local banking authorities. Integrated with our ALM & Liquidity solution, it empowers users with contract-level data management and customizable financial modeling for enhanced reporting and decision-making.

Mirai Regulatory Reporting

Solution Highlights

Integrated Internal & Regulatory Reporting

Manage internal IRRBB and liquidity risk alongside regulatory metrics and ALCO packs in an integrated environment. This ensures consistency, reduces errors, and fosters deeper insights.

Contractually Guaranteed Continuous Compliance

We guarantee compliance and readiness for future reforms. Our solution is regularly updated in alignment with regulatory changes or new reporting requirements.

Automated & Efficient Regulatory Report Generation

Access automatic EBA and Basel reports, along with reports for local governing bodies. Generate all reports simultaneously for optimal efficiency.

Deep dive into our advanced functionality

Mirai Regulatory Reporting Solution Capabilities

Powered by our cloud-native platform, our Regulatory Reporting solution introduces transformative use cases.

Regulatory Liquidity Rate Risk Reporting

Efficiently calculate and forecast the Basel liquidity coverage ratio (LCR) and net stable funding ratio (NSFR) based on client scenarios. Our solution allows for proactive estimation of potential breaches or fluctuations by projecting liquidity ratios (LCR, NSFR). Supported reporting includes:

- Liquidity Coverage Ratio (LCR)

- Net Stable Funding Ratio (NSFR)

- Additional Monitoring Metrics (AMM)

- Asset Encumbrance (AE)

Regulatory Interest Rate Risk Reporting

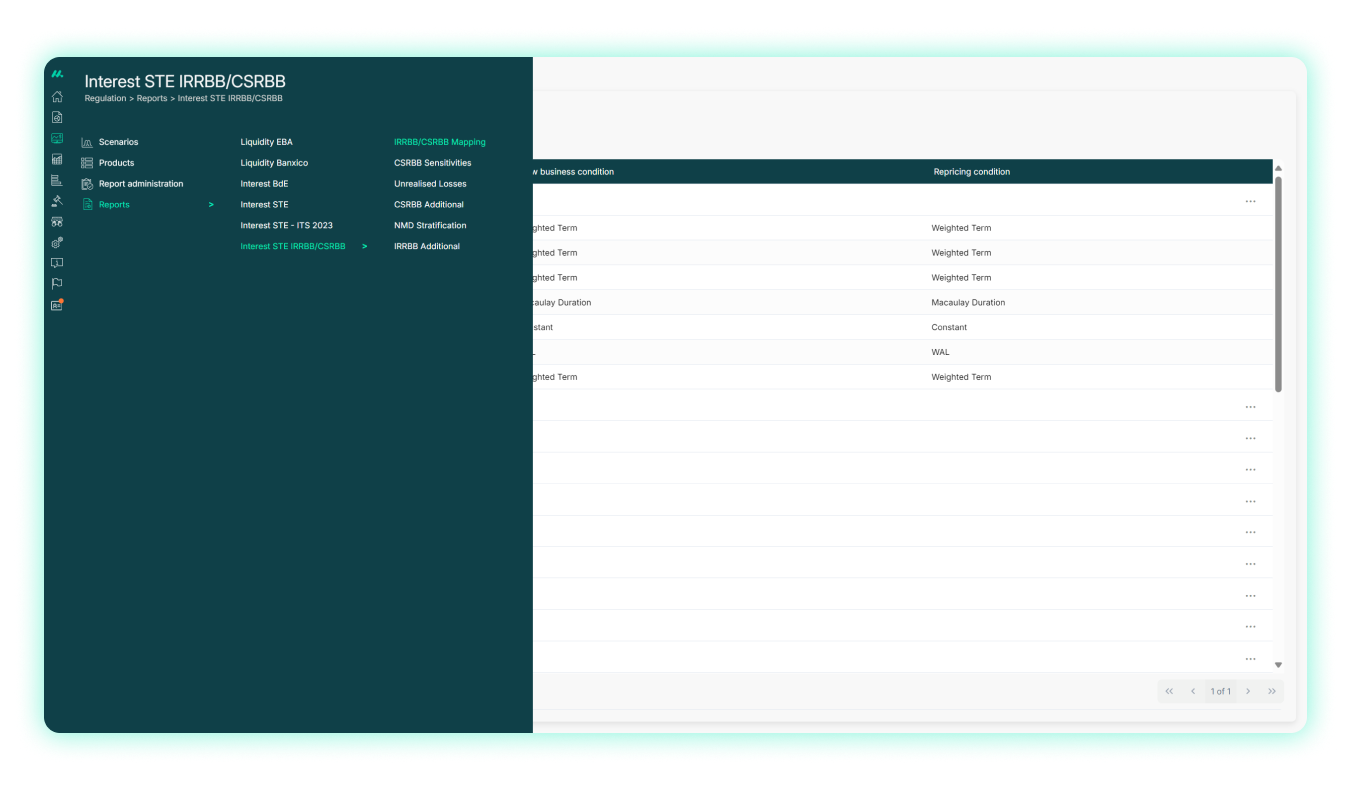

Leverage our reporting functionality for both standardized framework and internal modeling approaches, ensuring alignment with regulatory requirements for interest rate risk in the banking book (IRRBB).Supported reporting includes:

- EBA CSRBB / IRRBB

- EBA Supervisory Team Evaluation Process (STE) Reporting for IRRBB

- EBA STE Assumptions

Up-to-date regulatory Templates

Access the latest official templates promptly via our up-to-date regulatory templates. Our dedicated team of subject-matter experts meticulously monitors regulatory changes from every authority and ensures timely updates within our solution templates. Additionally, we offer a contractual guarantee that every new regulatory request will be available on our platform before it becomes mandatory, effectively shielding our clients from exposure to regulatory changes.

Report Filling, Export and Analysis

Effortlessly generate regulatory reports by mapping dimensions to regulatory products, establishing internal rules, and defining metric parameters. Seamlessly export reports to Excel using official templates for regulatory submission, with support for filtered exports to streamline in-depth analysis. Reports can be simultaneously generated for maximum efficiency.

Regulatory Adjustments and Checks

Enhance report quality with our robust audit capabilities, which identify missing or flawed data. Mirai facilitates adjustments at both the epigraph and operational levels, maintaining a record of changes and providing before-and-after data for each adjustment. Additionally, Mirai conducts checks on reports and regulators, enabling swift and effective analysis and supervision of metrics

Regulatory Forecasting

Anticipate how different scenarios may affect compliance and financial performance by simulating regulatory metrics through what-if analysis. Mirai's forecasting and simulation capabilities enable proactive management of regulatory indicators. Liquidity ratios such as LCR/NSFR can be simulated, considering the impacts of what-if decisions, budgeted new business issuance, multiple scenarios, or strategies. This optimization assists institutions in effectively managing the costs associated with liquidity holding.

Ready to achieve seamless and

continuous regulatory compliance?

Reach out to our expert team to schedule a personalized

demo and see a live solution walkthrough.